nh property tax rates by town 2019

The tax rate for 2020 was set at 28551000 valuation. Posted on December 15 2020 by December 15 2020 by.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

All banks mortgage rates are different.

. This process includes compiling assessment data conducting ratio studies and preparing statistical reports. State Education Property Tax Warrant. Joe Shimkus NEW -- Massachusetts Property Tax Calculator NEW -- New Jersey Property Tax Calculator NEW -- Historical New Jersey Property Tax Rates NEW -- Historical Massachusetts Property Tax Rates NEW -- 2021 NH Property Tax Rates NEW -- 2022 Connecticut Mill Rates for All Towns and Cities NEW -- 2022 Iowa County Tax Rates 2021 Vermont Education School.

236 rows Town Total 2020 Tax Rate Change from 2019. 2019 property tax rates for new hampshire cities and towns. 603 664-9007 Website Disclaimer Government Websites by CivicPlus.

Property tax bill can be viewed at. Pin On Lugares Que Visitar Espite the 15 increase in thed taxpayers av their property tax bll. 96264150 969 286 229 1319 2803 110900900 256 109 216 904 1485 179210493 613 181 221 1263 2278 283161071 1012 274 210 1519 3015 159681536 610 373 218 1504 2705 1712453686 395 134 209 661 1399 1668197508 544 125 224 1830 2723 245812068 484.

The New Hampshire Department of Revenue Administration is releasing 2019 tax rates for communities. Box 660 333 Calef Highway Rte. We are working hard at giving you the real time quotes for every county and lender.

Assessing 2020 Property Inventory Effingham Property Revaluation 2020 Assessment vs Market Value Frequently Asked Question re Assessment Pro Beginning. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. 125 Barrington NH 03825 PH.

Evaluate towns by county and compare datasets including Valuation Municipal County Rate State and Local Education tax dollar amounts. Nh property tax rates by town. 2018 property tax rates for new hampshire cities and towns.

Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year. State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate seacoast beaches during the COVID-19 pandemic. Tap or click any marker for more information From Concord to Keene to Rye to Jackson to Nashua.

Although the Department makes every effort to ensure the accuracy of data and information. Values Determined as of April 1st each year. Click on the Tax Year to view reports.

The nh department of revenue administration has all the nh city and town tax rates and valuations online. 6035397770 Call the Selectmens Office or email. All documents have been saved in Portable Document Format.

2021 nh property tax rates. Nh property tax rates by town 2020. 2021Town Tax Rate358School Tax Rate - LOCAL1332School Tax Rate - STATE173County Tax Rate079TOTAL1942 2020 Town Tax Rate335 School Tax Rate - LOCAL1291 School Tax Rate - STATE170 County Tax Rate080TOTAL1876Median Ratio 1002 2019Town Tax Rate449School Tax Rate - LOCAL1479Scho.

Statistical Reports - Each file contains 2 or 3 Lists Alpha and County or Alpha County and. Not all towns and cities have had their tax rates calculated yet however. State education property tax warrant all municipalities 2020.

15 15 to 25 25 to 30 30. Equalization reports prior to 2010 are available by request by calling the department at 603 230-5950. Tax Rate and Ratio History.

The following are the reports published for the 2019 Tax Year. The Town Clerk Tax Collectors Office can process Hunting Fishing Licenses as well as Boat Registrations. Town of Strafford Tax Abatement form -CLICK HERE-.

Uncategorized nh property tax rates by town 2019. Montana State Taxes Tax Types In Montana Income Property Corporate. Form PA-28 Inventory of Taxable Property.

New Hampshire Property Tax Rates. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. View this page for training videos reference guide and other information pertaining to the.

Welcome to New Hampshire Property Taxes Listings New Hampshire Property Taxes. New Hampshire Department of Revenue Administration Completed Public Tax Rates 2019 Municipality Date Valuation w Utils Total Commitment Alstead 110619 163042993 4512141 Alton 110519 1750226594 21548778 Alexandria 103119 197038051 4661699 Allenstown 110619 295309596 9060367 Acworth 110819 98419656. Property Tax Year is April 1 to March 31.

No Inventory List of Towns NOT Using the PA-28. 240 rows In New Hampshire the real estate tax levied on a property is calculated by multiplying the. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes.

State Corporate Income Tax Rates And Brackets Tax Foundation

California Has Trillions More Wealth Than Any Other State California New Hampshire Maryland

File Income Tax Return Before 31st March 2019 Expires Income Tax Tax Return Income Tax Return

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance

Lot 82 Timbershore Drive Conway Nh 03813 To Be Built And Can Break Ground Spring Of 2019 As Dream House Exterior Dream House Ideas Kitchens Modern Exterior

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

Redfin Ranks The 10 Hottest Affordable Neighborhoods Of 2019 The Neighbourhood Nevada Real Estate Real Estate Articles

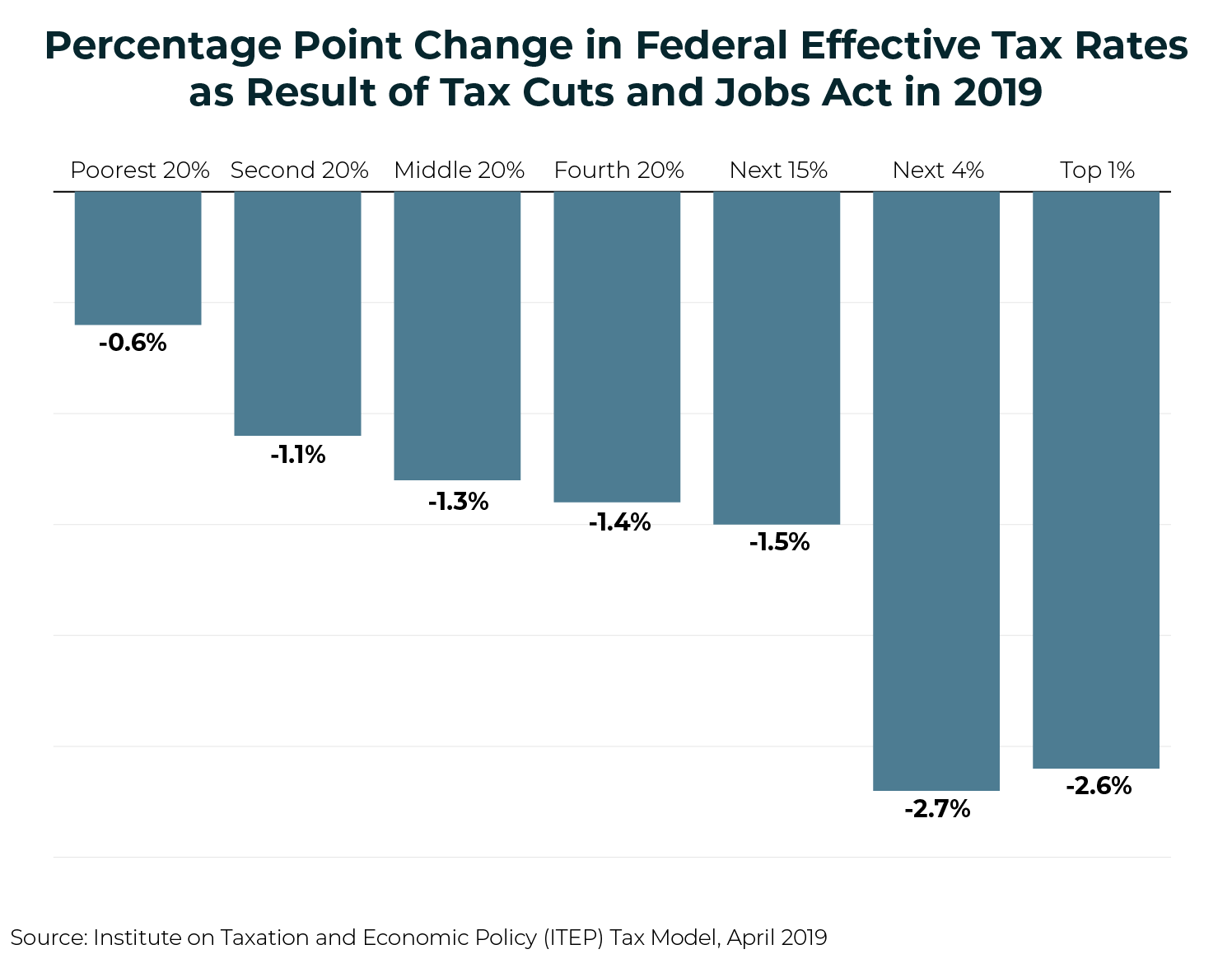

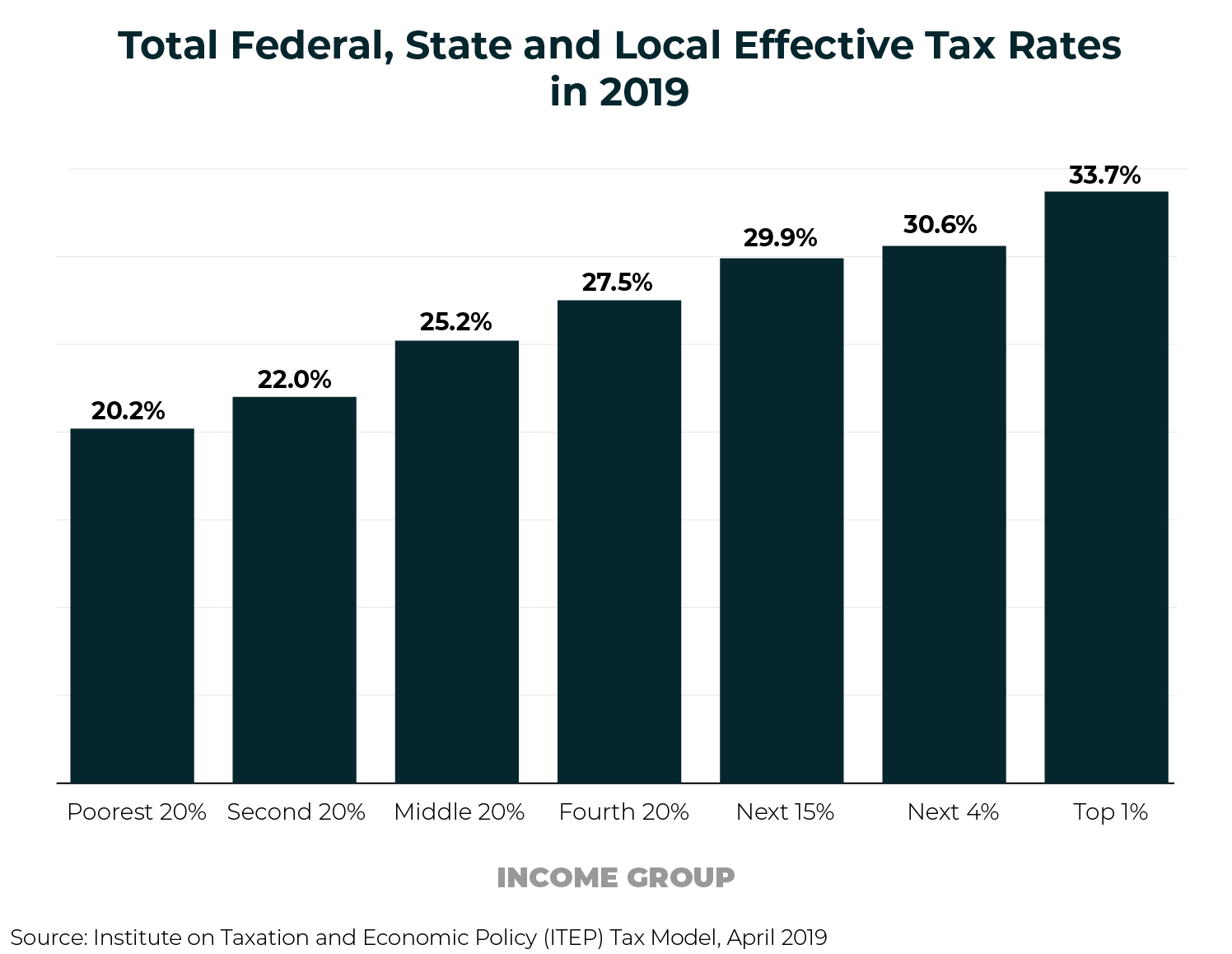

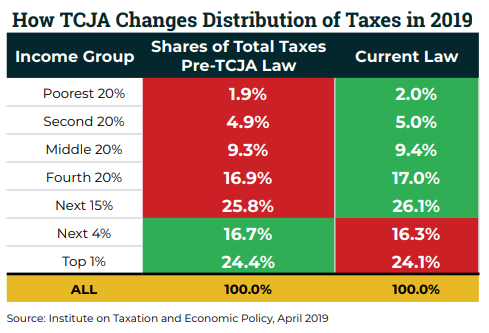

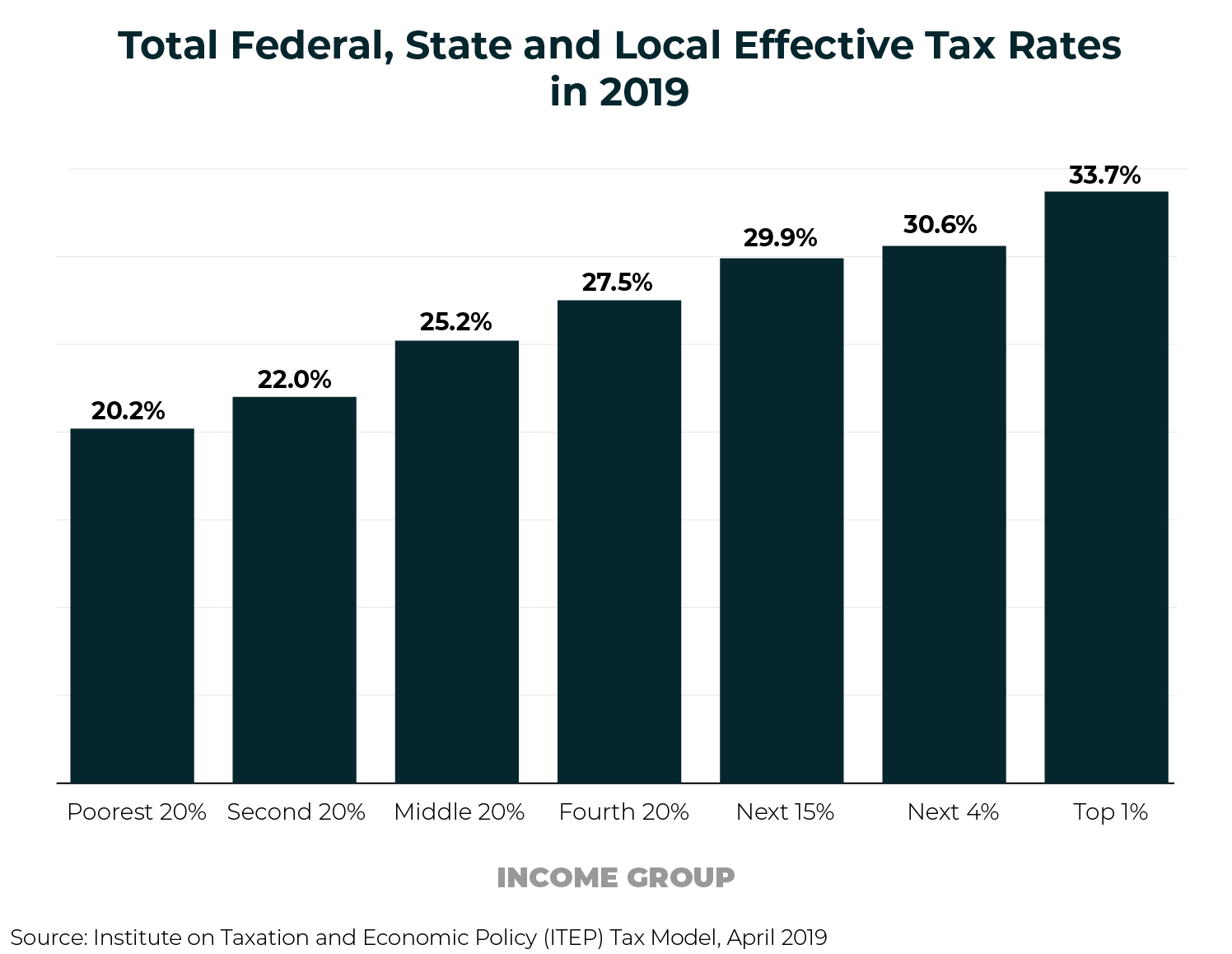

Who Pays Taxes In America In 2019 Itep

Top States To Buy Real Estate In The New Decade Financial Samurai Real Estate Buying Real Estate Real Estate Prices

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Property Taxes By State 2017 Eye On Housing

Real Estate Experts Say To Watch These 15 Markets In 2019 Real Estate California Real Estate Estates

Who Pays Taxes In America In 2019 Itep

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center